[h=1]

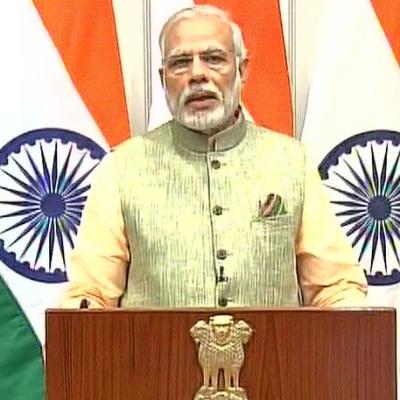

8 steps taken by Narendra Modi government against the menace of Black Money[/h]

Lists 8 steps taken by the Modi government to curb the menace of Black Money

The Narendra Modi led NDA Government has undertaken a lot of measures to check the menace of foreign and domestic black money.

We discuss these measures in this piece.

… problem of parallel economy and black money are largely inherited due to era of socialism between 1960-80s…

1.

Constitution of SC Monitored SIT on Black Money

The very first decision of the newly elected Narendra Modi Government at its very first meeting of the Council of Ministers was to constitute a Supreme Court monitored Special Investigation Team (SIT). This clearly establishes the positive intent of the Government to deal with the menace of Black Money.

2.

Renegotiation of Tax Treaties and Automatic Information Exchange Agreements with Tax Havens such as Mauritius, Switzerland, etc.

The government has renegotiated the Double Tax Avoidance Agreement (DTAA) with Mauritius to impose Capital Gains Tax if such Capital Asset is situated in India.

The government has also negotiated an Automatic Information Exchange Agreement with Switzerland.

Agreements on the above pattern are also being negotiated / renegotiated with other tax jurisdictions / tax havens.

From 2017, OECD (Organisation of Economic Cooperation and Development) countries have agreed to share information on foreign account holders with their home countries.

All these measures will make it much harder to hide cash abroad as well as round tripping of funds to India.

3.

The Black Money (Undisclosed Foreign Income and Assets)

and Imposition of Tax Act, 2015 for Foreign Black Money

The scheme was to bring back black money stashed abroad and its compliance window ended on 30 September, 2015. Whilst the total disclosures under this Scheme were underwhelming, the Act also has various stringent provisions for penalty and prosecution of foreign Black money holder’s unearthed during future investigation by the tax department.

4.

Income Declaration Scheme 2016 for unearthing Domestic Black Money

This is an ongoing scheme for unearthing domestic black money whose compliance window is to end on 30 September, 2016. The attraction for black money holders is that it will give them immunity from prosecution. Whilst the success or failure of the Scheme lies in the future, it is publicly stated as the last and final opportunity for tax evaders to come clean in the eyes of law.

5.

Penalty on Real Estate Transactions undertaken in Cash

exceeding Rs.20,000/-($297).

It is widely accepted that Real Estate is the pit where Indians hoard black money from the eyes of tax officials. One of the measures undertaken by the Government which has largely been unnoticed amd unreported by Media has been the move to impose a penalty of 20% on all cash transactions exceeding Rs 20,000/- to purchase or sell a property (real estate).

6.

Tax Collection at Source on Cash Sales exceeding

Rs.2,00,000/- ($2970)

Another important measure to curb high value cash transactions and create an audit trail is to impose Tax Collection at Source at a nominal rate of 1% on cash purchases exceeding Rs 2 lakhs.

7.

Benami Transaction (Prohibition) (Amendment)

Bill

This Bill is pending in the Parliament thanks to the logjam created by the opposition. The toothless Benami Transactions (Prohibition) Bill, 1988 was rendered ineffective because Rules were never framed by the Central Government to effectively bring the same into action. The proposed new Bill also contains various provisions for Investigations, Penalty and Prosecution of Benami transactions which will add more fighting capability to the enforcement agencies.

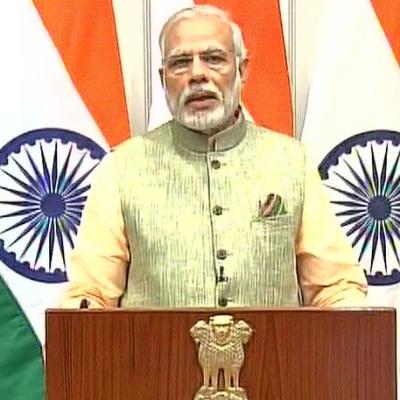

8. Narendra Modi’s

warning to Tax Evaders in his interview to Times Now Journalist Mr. Arnab Goswami

Narendra Modi issued a no holds barred public warning to tax evaders to come clean in his interview with Times Now promising action against offenders after the end of the compliance window.

Read more at:

https://www.pgurus.com/actions-taken-narendra-modi-government-menace-black-money/