I was under the opinion that Service tax is charged by Government! But actually it is being used in lieu of tips...But as we are unaware about this, we pay tips too..So the Service tax actually goes to fill the coffers of the Hoteliers!! The clarification is long over due!!

[h=1]Consumer can choose NOT to pay service charge: Govt [/h]January 02, 2017 16:46

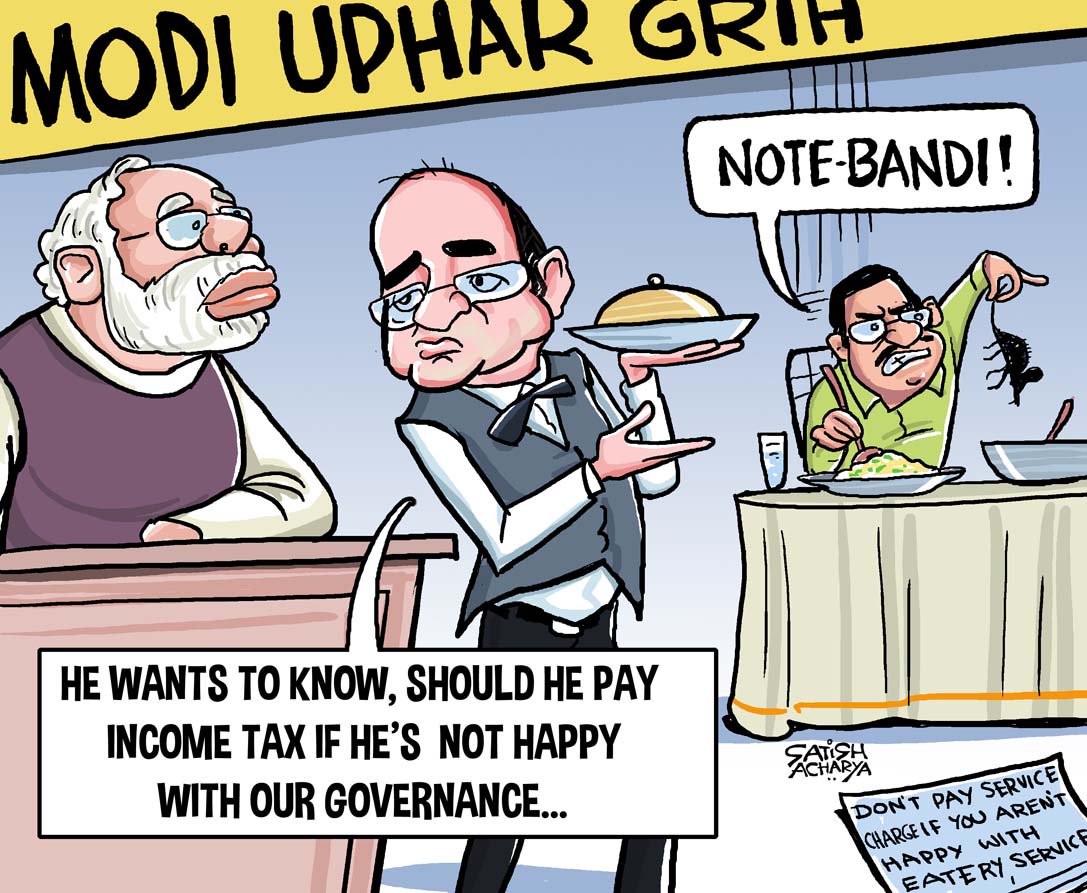

The Department of Consumer Affairs on Monday said that it is optional on restaurants to add service charges in addition to taxes in the bill and the consumer has discretion to pay service charge or not.

This is the full statement:

"A number of complaints from consumers have been received that hotels and restaurants are following the practice of charging service charge in the range of 5-20%, in lieu of tips, which a consumer is forced to pay irrespective of the kind of service provided to him.

"The Consumer Protection Act, 1986 provides that a trade practice which, for the purpose of promoting the sale, use or the supply of any goods or for the provision of any service, adopts any unfair method or deceptive practice, is to be treated as an unfair trade practice and that a consumer can make a complaint to the appropriate consumer forum established under the Act against such unfair trade practices.

"In this context, the department of Consumer Affairs, Central Government has called for clarification from the Hotel Association of India, which have replied that the service charge is completely discretionary and should a customer be dissatisfied with the dining experience he/she can have it waived off. Therefore, it is deemed to be accepted voluntarily."

Service charge is collected by the restaurant for rendering its service to you. It is not a tax and is not levied by the government but purely charged by the restaurants. They are free to charge any amount as there are no guidelines, but it usually varies from 4 to 10 percent

http://news.rediff.com/commentary/2...-charge-govt/f438a50a2ab6b5880c61fe60e009168e

[h=1]Consumer can choose NOT to pay service charge: Govt [/h]January 02, 2017 16:46

The Department of Consumer Affairs on Monday said that it is optional on restaurants to add service charges in addition to taxes in the bill and the consumer has discretion to pay service charge or not.

This is the full statement:

"A number of complaints from consumers have been received that hotels and restaurants are following the practice of charging service charge in the range of 5-20%, in lieu of tips, which a consumer is forced to pay irrespective of the kind of service provided to him.

"The Consumer Protection Act, 1986 provides that a trade practice which, for the purpose of promoting the sale, use or the supply of any goods or for the provision of any service, adopts any unfair method or deceptive practice, is to be treated as an unfair trade practice and that a consumer can make a complaint to the appropriate consumer forum established under the Act against such unfair trade practices.

"In this context, the department of Consumer Affairs, Central Government has called for clarification from the Hotel Association of India, which have replied that the service charge is completely discretionary and should a customer be dissatisfied with the dining experience he/she can have it waived off. Therefore, it is deemed to be accepted voluntarily."

Service charge is collected by the restaurant for rendering its service to you. It is not a tax and is not levied by the government but purely charged by the restaurants. They are free to charge any amount as there are no guidelines, but it usually varies from 4 to 10 percent

http://news.rediff.com/commentary/2...-charge-govt/f438a50a2ab6b5880c61fe60e009168e