-

Welcome to Tamil Brahmins forums.

You are currently viewing our boards as a guest which gives you limited access to view most discussions and access our other features. By joining our Free Brahmin Community you will have access to post topics, communicate privately with other members (PM), respond to polls, upload content and access many other special features. Registration is fast, simple and absolutely free so please, join our community today!

If you have any problems with the registration process or your account login, please contact contact us.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

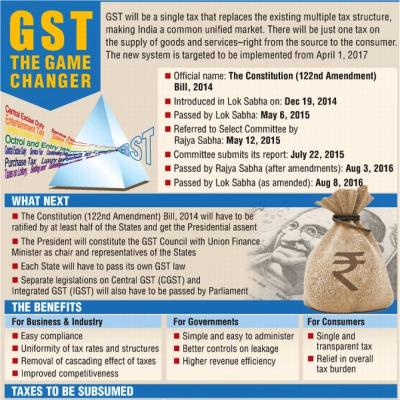

'All issues resolved': GST in Parliament on Wednesday

- Thread starter vgane

- Start date

- Status

- Not open for further replies.

tbs

0

hi'Unfair, arbitrary and unconstitutional': Why Tamil Nadu opposed the Goods and Services Tax

Tamil Nadu argued that it violates India's federal structure.

Read more at: http://scroll.in/bulletins/13/from-...dians-are-showing-us-that-all-is-within-reach

never trust the friends in politics.....

V

V.Balasubramani

Guest

CEA Arvind Subramanian’s 18 per cent GST old hat, says Centre

New Delhi: The Centre on Thursday virtually washed its hands off the CEA Arvind Subramanian report that standard rate for GST be at 17-18 per cent, saying that the report was based on old data of 2013 and now new realities had to be looked at while calculating GST rate. Revenue Secretary Hasmukh Adhia said that today most goods are taxed at around 27 per cent and cautioned media against using 18 per cent as standard rate for GST, calling it “pre-mature”.

This may point that GST standard rate is likely to be higher than 18 per cent. Mr Adhia said that Centre is hopeful to get the approval of 16 states within 30 days required for President to notify GST council. “The calculation which CEA report has done and NIPFP has done, is based on taxable base of state and Centre as in 2013-14. Since then a lot of things have happened more in state and Centre level. We need to account for those changes which have happened in last two years. For example Centre government has come with many more cess in last two years. So the calculation does not include those cess etc.,” said revenue secretary Hasmukh Adhia.

Congress had been demanding a cap in the GST at 18 per cent in the bill on the basis of Mr Subramanian panel report. Interestingly, Mr Subramanian had given his report in December 2015 only. However, in the evening CEA said that while a GST rate of close to 22 per cent will put inflationary pressure, higher rate of 27 per cent will become totally self-defeating. “At 27 per cent it is totally self-defeating...Up to 18-19 per cent there will be minimal impact on inflation and if it goes to 22 per cent there will be a few basis point increase,” Mr Subramanian warned.

Read more at: http://www.deccanchronicle.com/business/economy/050816/gst-rate-splits-key-officials-at-centre.html

New Delhi: The Centre on Thursday virtually washed its hands off the CEA Arvind Subramanian report that standard rate for GST be at 17-18 per cent, saying that the report was based on old data of 2013 and now new realities had to be looked at while calculating GST rate. Revenue Secretary Hasmukh Adhia said that today most goods are taxed at around 27 per cent and cautioned media against using 18 per cent as standard rate for GST, calling it “pre-mature”.

This may point that GST standard rate is likely to be higher than 18 per cent. Mr Adhia said that Centre is hopeful to get the approval of 16 states within 30 days required for President to notify GST council. “The calculation which CEA report has done and NIPFP has done, is based on taxable base of state and Centre as in 2013-14. Since then a lot of things have happened more in state and Centre level. We need to account for those changes which have happened in last two years. For example Centre government has come with many more cess in last two years. So the calculation does not include those cess etc.,” said revenue secretary Hasmukh Adhia.

Congress had been demanding a cap in the GST at 18 per cent in the bill on the basis of Mr Subramanian panel report. Interestingly, Mr Subramanian had given his report in December 2015 only. However, in the evening CEA said that while a GST rate of close to 22 per cent will put inflationary pressure, higher rate of 27 per cent will become totally self-defeating. “At 27 per cent it is totally self-defeating...Up to 18-19 per cent there will be minimal impact on inflation and if it goes to 22 per cent there will be a few basis point increase,” Mr Subramanian warned.

Read more at: http://www.deccanchronicle.com/business/economy/050816/gst-rate-splits-key-officials-at-centre.html

CEA Arvind Subramanian’s 18 per cent GST old hat, says Centre

New Delhi: The Centre on Thursday virtually washed its hands off the CEA Arvind Subramanian report that standard rate for GST be at 17-18 per cent, saying that the report was based on old data of 2013 and now new realities had to be looked at while calculating GST rate. Revenue Secretary Hasmukh Adhia said that today most goods are taxed at around 27 per cent and cautioned media against using 18 per cent as standard rate for GST, calling it “pre-mature”.

This may point that GST standard rate is likely to be higher than 18 per cent. Mr Adhia said that Centre is hopeful to get the approval of 16 states within 30 days required for President to notify GST council. “The calculation which CEA report has done and NIPFP has done, is based on taxable base of state and Centre as in 2013-14. Since then a lot of things have happened more in state and Centre level. We need to account for those changes which have happened in last two years. For example Centre government has come with many more cess in last two years. So the calculation does not include those cess etc.,” said revenue secretary Hasmukh Adhia.

Congress had been demanding a cap in the GST at 18 per cent in the bill on the basis of Mr Subramanian panel report. Interestingly, Mr Subramanian had given his report in December 2015 only. However, in the evening CEA said that while a GST rate of close to 22 per cent will put inflationary pressure, higher rate of 27 per cent will become totally self-defeating. “At 27 per cent it is totally self-defeating...Up to 18-19 per cent there will be minimal impact on inflation and if it goes to 22 per cent there will be a few basis point increase,” Mr Subramanian warned.

Read more at: http://www.deccanchronicle.com/business/economy/050816/gst-rate-splits-key-officials-at-centre.html

We can now expect GST at anything above 20%

Already Assam & Bihar assemblies have ratified the GST Bill...Now Pranabda is going to sign this...Great progress!

[h=1]Pranab keen to sign GST bill [/h]

August 16, 2016 15:50

Union minister for Finance Arun Jaitley spent an hour explaining to President Pranab Mukherjee about the Constitutional amendment 122 on the Goods and Services Tax and its passage in Parliament. The President, who has handled the finance ministry portfolio in the UPA government, congratulated Jaitley, and said he wanted the government to speed up the process especially since 16 state assemblies have to pass it. More than the BJP, the President seems to be thrilled over the aspect of signing the bill. Parliament will take up the GST bill during the Winter session. President Mukherjee's term ends in July 2017.

http://news.rediff.com/commentary/2...ign-gst-bill/0b96c0c126dacd15b3c3c5600ad48a17

[h=1]Pranab keen to sign GST bill [/h]

August 16, 2016 15:50

Union minister for Finance Arun Jaitley spent an hour explaining to President Pranab Mukherjee about the Constitutional amendment 122 on the Goods and Services Tax and its passage in Parliament. The President, who has handled the finance ministry portfolio in the UPA government, congratulated Jaitley, and said he wanted the government to speed up the process especially since 16 state assemblies have to pass it. More than the BJP, the President seems to be thrilled over the aspect of signing the bill. Parliament will take up the GST bill during the Winter session. President Mukherjee's term ends in July 2017.

http://news.rediff.com/commentary/2...ign-gst-bill/0b96c0c126dacd15b3c3c5600ad48a17

- Status

- Not open for further replies.

Similar threads

- Replies

- 14

- Views

- 890

- Replies

- 0

- Views

- 849

- Replies

- 6

- Views

- 2K

R

Latest ads

-

For rent [Property for Rent] Bangalore independent house for ShraddaHi all, Namaskarams!! My brother has 3BHK independent house in very main area in Vijaya Bank...

- ramchan10 (+0 /0 /-0)

- Updated:

-

Wanted Wanted for rentLooking for a flat / independent house for rent.

- Gaurdeepak (+0 /0 /-0)

- Updated:

- Expires

-

Wanted [Cook Wanted] Cook Mami for 13 days ritualsHi.. If anyone has contact of any cook Mami based out of Coimbatore who can provide sattvic food...

- send2ramyakumar (+0 /0 /-0)

- Updated:

-

For rent [Property for Rent] Spacious (2000 sq ft) independent house for rentPallikkaranai independent house for rent

- jaradhva (+0 /0 /-0)

- Updated:

- Expires

-

Service [Others] Packing foodBrahmins home made Packing lunch avilable morning breakfast -80rs, Lunch ,-...

- Kum (+0 /0 /-0)

- Updated: