prasad1

Active member

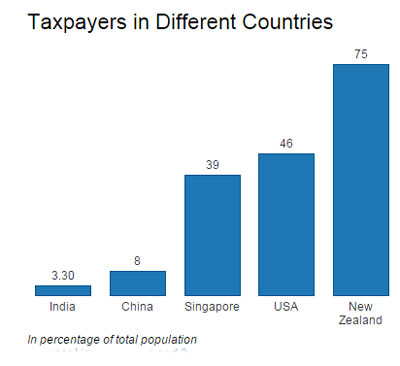

It’s reasonably well known that income from agriculture attracts no tax in India.

What isn’t quite as well known is that of more than 400,000 taxpayers claiming exemption for agricultural income in the assessment year 2014-15, the biggest were seed giant Kaveri Seeds - it claimed Rs 186.63 crore (Rs 1.87 billion) exemption and made a profit of Rs 215.36 crore (Rs 2.15 billion) before tax - and multinational Monsanto India, which claimed Rs 94.40 crore (Rs 944 million) as exemption from agricultural income and earned Rs 138.74 crore (Rs 1.39 billion) profit before tax.

Agro-companies growing crops are allowed the same tax relief as individuals in states levying no agricultural income tax, although some states do indeed tax some kind of farming.

Top 10 Claimants For Tax Exemption of Agricultural Income, 2013-14

Kaveri Seed Company Limited

186.6

Monsanto India Limited

94.4

McLeod Russel India Limited

73.1

Madhya Pradesh Rajya Van Vikas Nigam

62.6

Vandana Farms & Resorts Private Limited

61.1

Karnataka Forest Development Corporation Limited

Ankur Seeds Pvt Ltd

27.6

Nath Bio-genes (India) Limited

27.4

Shivashakti Bio Technologies Limited

21.6

Ganga Kaveri Seeds Private Limited

19.6

“Allowing big farmers - individuals or companies farming more than say 30 acres - agricultural income-tax exemption makes no sense,” said R Durairaj, CEO and founder, Mother India Farms, an organic farm. Durairaj farms 200 acres of family land and supports agricultural-income-tax reform - although he does not pay any tax on his agricultural income.52.8.

http://www.rediff.com/business/spec...with-rs-215-cr-profit-pay-no-tax/20160316.htm

Last edited: